Nobody wants to be in debt, but there are times that it is just inevitable. Just like the fact that people need student loans, car loans, and mortgage, debt is something almost no one could avoid unless you are from a wealthy family wherein you wouldn’t need to worry about being in debt.

According to recent reports from financial expert studies, the millennial generation will be the ones who will have a hard time preparing for their retirements since they are not exactly worried about it.

Most of them are just living their lives the way they want to and aren’t exactly looking into the futures ahead of them. Then again, before them, there are the baby boomers or the generation X.

They will be the ones who are getting into retirement soon, and based on statistics from the Federal Reserve Bank of New York, the baby boomers are definitely ready for retirement, however, their debt is too far from being ready.

Baby boomers are most likely to get into retirement with debt

Baby boomers are most likely to get into retirement with debt

Debt Into Retirement

In a similar report, it turns out that the highest debt rate in the country has reached $1 trillion this year, and most of them are actually carrying debt into retirement. In the years between 2003 up to 2015, 48 percent of the people who have retired carry their debts in their retirement.

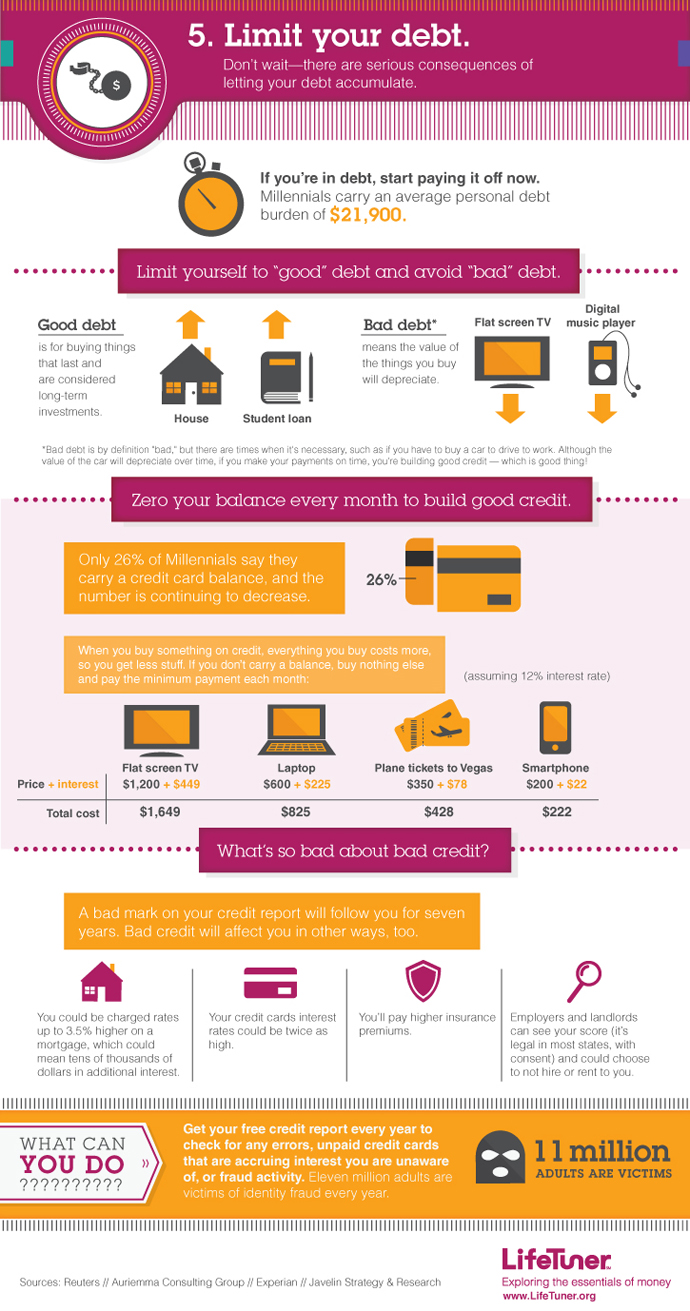

According to experts, it is always ideal to evaluate your debts, that way you can actually identify which one you should prioritize to pay off first. Based on a recent study from the University of Michigan Retirement Center, people are reaching their retiring age in the United States are about to retire while they are still in debt.

Over the years, the percentage has grown from 61 percent to 71 percent this year. One of the main reasons is that most of these adults have yet to pay off their mortgages.

The study also found out that most of them have chosen to get such pricy homes with small down payments, which means they are paying it off a little too slow that it has reached their retirement age.

There are also some of them who said that they had to prioritize their student debt first before actually paying off and focusing on their mortgage. Financial experts said that it is never a good thing to pay off debt once you retire since retirement is supposed to be the point where you must not worry about financial stability, you have worked your entire life to have a good retirement and debt will take away most of it.

However, they also explained how there are cases that it could be considered as a good debt, but in most cases, it is a bad debt. Baby boomers is the generation the are getting close to retirement and study said that they are too far from being ready for it. Most of them may have some high incomes and greater financial sophistication, but they could also be in debt, especially now that more and more people are getting attached to their credit cards.

Debt in retirement is never a good thing according to experts

Debt in retirement is never a good thing according to experts

Avoiding Debt As Early As Now

Experts believe that the best way to not worry about debt when you’re about to retire is to live simply as early as now. Millennials can start to live like this and it is not too late for baby boomers to actually do as well.

Let go of FOMO or the fear of missing out, and start a practical life. If you can avoid having a credit card or have just one then go ahead. Debt pushes people to the ground because it lets them use money that they don’t have and they will end up spending more because of it.

Debt is inevitable sometimes which is why it is best to focus on getting loans that you know would benefit you the most, such as a mortgage that would suit you and not something that would take you a hundred years to pay off.

Car loans are also ideal but they tend to lose market value over time so make sure that you get what you need and not just because everyone has one and it makes you look cool. However, the most important thing to remember is to have a stable job, you must ensure that you have a great source of income before you actually get any sort of loan, or else, it will definitely take you to wrong places on the future.