If you ever look up at the house prices in the Western states and wonder how would you be able to pay the down payment, your state can help you in one way. For this, one should be aware of “home buyers accounts for the newbies.”

There are many state legislatures who allow such programs which give a tax advantage to those saving for buying a house. Almost a dozen states have approved these options and Alabama and Oregon are the latest addition to the series. And there are many other states considering this option.

While commenting on this, the senior policymaker and analyst of the Tax Foundation in Washington, Jared Walczak said that these accounts will help renters with a tax advantage and save money for the down payment. In some states, these accounts are not only for the first-time buyers but also for those who haven’t bought a house for years, Walczak added.

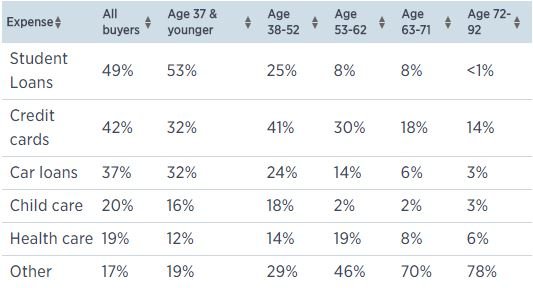

First-time buyers make a small portion of house sales and according to the 2017 stats of the National Association of Realtors, the percentage of first-time buyers has dropped to 32, which has crossed the national average of 40%. While commenting on these stats, president of the Pennsylvania Association of Realtors, Todd Umbenhauer said that these stats are very important and only a small amount of first-time buyers is entering the market. One main reason for this is the rising house prices.

According to the stats of Zillow, $238,800 is where the average median sale has reached and this is all due to the imbalance between the supply and demand of the property. According to the experts, house values have increased 8.7% over the last year and expected to rise 6.5% more in next year.

First-time home buyer savings accounts got bipartisan support in Umbenhauer’s sate. The new buyers of Pensylvania would be able to put up $50,000 in a designated account over the period of 10 years.

And the yearly contributions will have a limit of $5,000 for the individuals and $10,000 for the married couple, and would also be tax deductible. For the ease of the buyers, the designated accounts can be open in any financial institution of the state like brokerages and banks.

However, savers can open the accounts with their own name or with the name of the beneficiary. Just like other programs of the state, people who will not use the funds within a specific period of time will face a penalty.

To simplify things, these accounts will work same as 529 college saving plans. And just like the college saving plans, the funds can only be used for the qualified expenses. For example, these funds can be used in closing cost and down payment which is related to home buying costs.

Those who are in the favor of these accounts said that debts and rising house prices are the two things producing hurdles in their way and these accounts will only help them. While talking about the situation of home buyers in Oregon, the policy analyst of Oregon Center for Public Policy, Daniel Hauser, said that house rents in some areas of Oregon states are so high that homebuyers cannot save anything for the down payment.

And this program says that if a person has a saving for down payment, that saving would be tax-free, Hauser added. But you can’t have the benefit if you can’t save.

By 2019, the people will be able to deduct up to $5,000 as suggested by this Oregon program. The Oregon state also imposed a limit on income for the people who can get benefit from this program.

Such programs started coming in practice in the last couple of years with states like Minnesota, Iowa, Colorado, and Mississippi. First such account was established in 1998 by Montana. According to Walczak, one of the main problems of these programs is that they are not well-known.

These accounts were established in 2014 in Virginia and there were only a few taxpayers who claimed the tax deduction. And according to the Department of Taxation, only 105 tax returns were included in the tax break in 2014 in Virginia.