According to a survey of GoBankingRates, there is no need to go to the beach to spend the late days of life. A time comes in everyone’s life when he/she puts all the working days behind and wants to enjoy the cash earned in entire life.

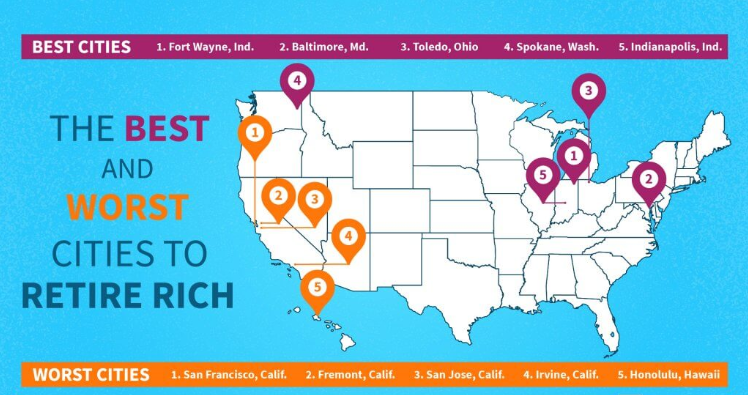

That survey suggests going to Midwest rather than out west. And there is no better place than Indiana when it comes to enjoying the cash. According to GoBankingRates, Indianapolis is among the list of top 5 places to visit in retiring days. And also the city is the third best option in Midwest region.

The number one spot was occupied by Fort Wayne which was then followed by Spokane, Wash, Baltimore, Ohio, and Toledo. The survey wasn’t proved good to California as it labels the state worst option to visit in retiring days.

The top five worst places according to the survey were San Francisco, San Jose, Fremont, and Irvine. And the only non-Californian city to make it to the list of top 5 worst places was Honolulu. According to the survey, the home affordability was the key factor for Indianapolis to go so far ahead.

The home values were median in all the cities which make it to the top 10 and the average value of the house in all the 10 cities is around $200,000. And this value is one-sixth of what the houses ranged in all the cities of California – $1.34 million.

The list of top 10 was rounded off by Memphis as the cities like Richmond, Tenn, Norfolk, Cleveland, Wichita, and Ohio made it to the list. While commenting on the survey, the deputy director of GoBankingRates, Sydney Champion said that a man who has saved all his life and when he/she decides to spend, the only thing that will hurt the savings in where the person decides to live.

Champion said that if a retiree wants to relocate after retirement, it is recommended to find a place which is suitable for his/her savings. And the house should not be so expensive that he/she keeps paying for that. If possible, the person should downsize and rent, the director continued.

The survey of GoBankingRates listed all the 50 states based on four factors: Social Security Benefits, Living Expenses, Taxes, and Healthcare. After that, these factors were further broken down into sets of data points. In the category of tax, the experts determined the tax imposed on property and social security benefits.

While in living expense category, they looked at the median and mean prices of the houses according to the cost-of-living index value of the corresponding state. And in the last, the experts looked at the health insurance premiums and average SSB in the category of health and social security benefits.

The survey also found that almost 42% of the Americans have $10,000 or less as a saving after retirement and these retires are recommended to visit places like Baltimore and Fort Wayne, which have low house prices as compared to the California which has average house price of $1 million.

The real culprit for the state of California was the high prices of living and even higher prices of buying a home. The cost of living in California is almost double the average national cost and that’s what makes it worse for the retirees.

While the worst states according to the survey aren’t too bad as Honolulu has the lowest property tax rates. The city has 0.91% tax rate, lowest among all the 96 cities which were taken into account in the survey. With 0.683%, San Francisco has the fifth lowest property tax rates. But these lower tax rates can be justified with the fact that the average property tax bill in San Francisco is over $9,000. While the same for Fort Wayne is $947 which has a tax rate of 0.915%.